Main content

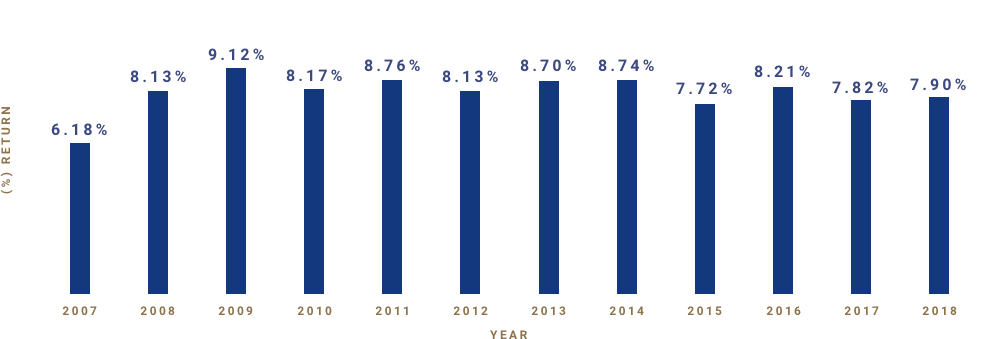

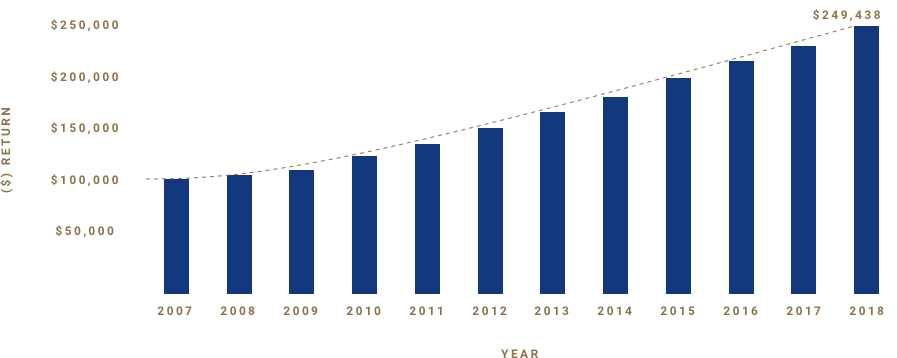

Our Results

Steady and Consistent Growth

PHL has generated steady, consistent returns since its inception in 2006.

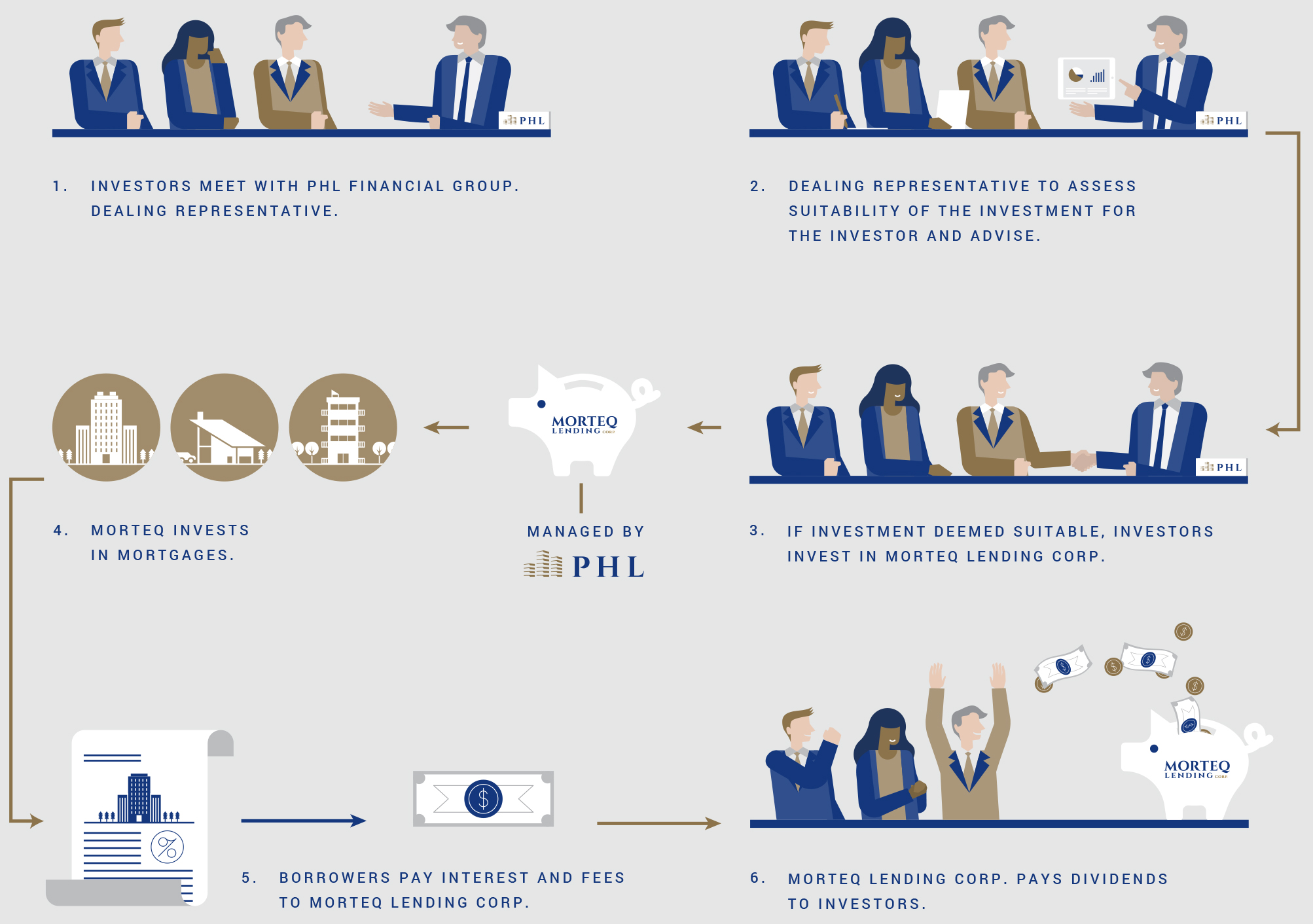

What is a MIC?

A Mortgage Investment Corporation (“MIC”) is an investment and lending company that allows investors to pool funds in a diversified and secured portfolio of residential and commercial mortgage loans. Shares of a MIC are qualified investments under the Canadian Income Tax Act (Section 130.1) for RRSP’s, RRIF’s, TFSA’s, LIRA’s, LIFF’s and RESP’s. The Income Tax Act requires that 100% of a MIC’s annual net income be distributed to its shareholders.

MIC Advantages

MIC’s offer investors a number of attractive advantages, including:

-

Experienced management

-

Each mortgage secured by tangible Real Estate

-

Historically Stable Returns

-

Investors own a diversified portfolio of mortgages

-

Typically higher yields than traditional investment products

-

Ability to invest via self-directed RRSP’s, RRIF’s, TFSA’s, LIRA’s, LIFF’s and RESP’s

established in 2006 and funded over $800 million in mortgages to date

The chart above illustrated the growth of a $100,000 investment since inception with compounding quarterly dividends only and no additional contributions.

Risk Mitigation

PHL has built a proven and established underwriting process upon the following fundamentals:

-

Strategic Lending Area

We offer financing primarily in Metro Vancouver and the Fraser Valley only, where both markets exhibit long-term stability, growth and liquidity.

-

Credit Committee

All mortgages are reviewed by our four-member credit committee.

-

Loan-to-Value Ratio

Our mortgages never exceed 75% of the appraised property value.

-

Approved Appraiser List

Every application requires a current appraisal prepared by a qualified and internally approved Appraiser.

-

Mortgage Security

All mortgage security prepared and reviewed by qualified legal counsel.

-

Stringent underwriting procedures and guidelines

These lending guidelines continue to help PHL successfully navigate the risks associated with real estate investment.

Dividends

Shareholders will be entitled to receive dividends on a quarterly basis. Dividends may be taken as cash or reinvested as additional shares. Dividends reinvested as additional shares will qualify for future dividends.

Dividends are paid out as follows:

Q1

Sept 1 – Nov 30

Dividend paid out by Dec 31st

Q2

Dec 1 – Feb 28

Dividend paid out by Mar 31st

Q3

Mar 1 – May 31

Dividend paid out by June 30th

Q4

June 1 – Aug 31

Dividend paid out within 90 days of fiscal year end